Saving money; a tricky one for many. It doesn’t feel like an essential, such as our rent/mortgage or bills. We don’t want to adapt our lifestyles as dramatically as we think we might need to. If we get a pay rise, we’d like to enjoy it, thanks very much. So it’s hard to save.

Behavioural economics tell us saving really is hard, it goes against our nature. The bias is called hyperbolic discounting – we value smaller, immediate rewards much more than rewards which come later, even if they are bigger.

Nudge nudge, save save

Of course financial services know this, and there are many attempts to make us think and act differently when it comes to spending and saving. It’s not lecturing as there’s lots of innovative techniques and messages to help us break the inertia.

- Fear = Aviva’s disruptive campaign – where they contrast the possibilities facing two 20-somethings when they live off their likely retirement income, in a bid to shock and encourage us to put more into pensions

- Mindset shift = Nationwide’s PayDay SaveDay, in an attempt to give saving the same status as rent paying; pro-actively saving before the month is out, rather than scratching around for what’s left at the end

- Easy, effortless, fun techniques = IFTTT (if this then that) rules can enable you to save every time it rains, or apps like Acorns which helps you save spare change by rounding up purchases

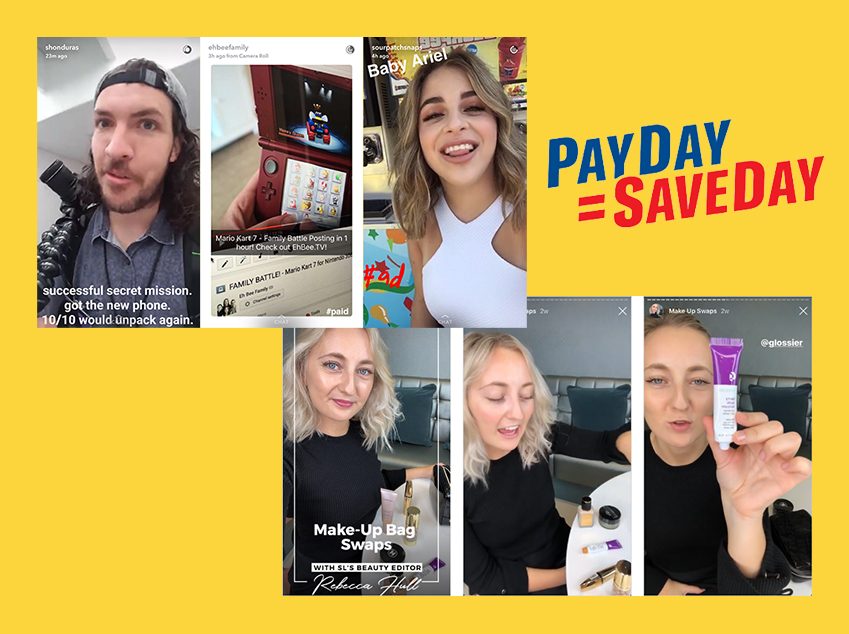

A drop in the ocean for social media

Whilst these campaigns and initiatives from financial services are admirable, we can’t help but wonder how impactful they can be against a backdrop of influencers flaunting their recent buys. Of course we all know the truth, that influencers are paid to represent brands, or get much of their talked-about purchases ‘gifted’. But that’s easily forgotten when scrolling through endless enviable images and a sense of community and support which tricks us into believing it could all be real.

The big message which cuts through loud and clear is **spend more** – either just by buying more, or by opting for products and experiences that are a cut-above your preferred price point.

The quieter, but no less harmful and damaging message is “this could happen to you too one day”. These influencers have ordinary lives, with few special skills or experience – just a great camera and a very patient room mate or partner to play photographer. Their lives changed quickly – almost overnight they have more money, gifts and status than they could have dreamed. This leaves followers thinking “why couldn’t that be me?” The possibility that a better selfie, with improved airbrushing and a slightly more aspirational setting could help anyone bag a £1,000 per post deal. And this ‘one day’ dreaming makes saving a little a month feel futile.

Fight back

We believe a social media revolution of some kind is coming – consumers are more readily seeing through these faux fairy tales. But financial services can’t rely on and wait for the consumer to rise up.

Their best bet is to more effectively tap into consumer emotions. Social media moments play into a sensation of Desire and Freedom. It’s a combination of excitement and anticipation mixed with a burst of energy we feel when doing new or different things. This is a really powerful sensation; a feeling of a transformed and slightly better you. The feeling puts greater weight on the end result – it helps us counteract hyperbolic discounting. It’s this sensation that drags teenagers out of bed for driving lessons; makes ordinary people work until the early hours on their side hustle; helps families embark on weeks of disruption to achieve their dream kitchen extension and encourages the worst with money to save up for designer sunnies.

We believe the next savings mechanics should play to that powerful sensation; ditch the fear and making it over-easy. Create some FOMO. Use social differently. Find a way to make savings as irresistible as the Instagram like button.